Which properties are likely to enjoy real rent growth through time?

The first piece on this series of “Measuring the Moat” discussed the life cycle of properties and showed that properties depreciate (in real terms) quickly after construction. Through time property value shrinks towards land value and this gravity is fought by constant reinvestment. Therefore, owning good land is the key to long-term investment. Simple, but not easy.

To identify properties that consistently appreciate in value, we’ll deviate from the industry standard of assuming 3% annual rent growth. By applying Porter’s Five Forces analysis, we can more accurately assess the underlying factors that contribute to long-term value appreciation

The Five Forces Model

Michael Porter’s Five Forces model is a framework for analyzing an industry’s competitive landscape. It assesses the impact of competitors, suppliers, buyers, potential new entrants, and substitute products on a company’s competitive position

I will do my best to offer some implications to real estate. Not all the forces are relevant for every property but some offer valuable insight

Threat of New Entrants

Of the five forces, this is the clearest and most relevant for real estate investors.

The threat of new supply can be impacted by several factors, but the three most important are:

1. Economics. To develop new property, developers and their investors need to earn sufficient return to justify their risk. Rents need to be high enough to justify development, which is why many rural and slow growth areas don’t see much development. On the expense side, elevated property taxes in places like Chicago or insurance in Florida, can bring down returns to make development less attractive.

2. Regulation. More regulation means less new development, all else equal. Many cities want development and others don’t, so it is no surprise to see developers focus in these pro-development areas, especially in Texas and the Southeast US.

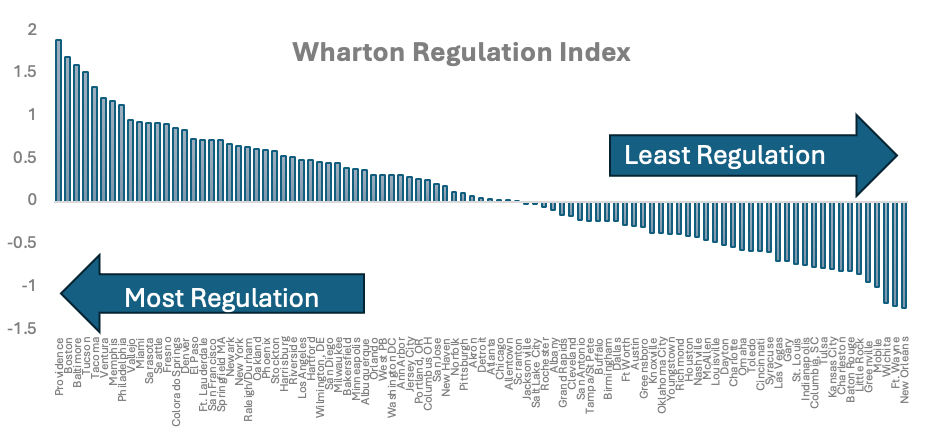

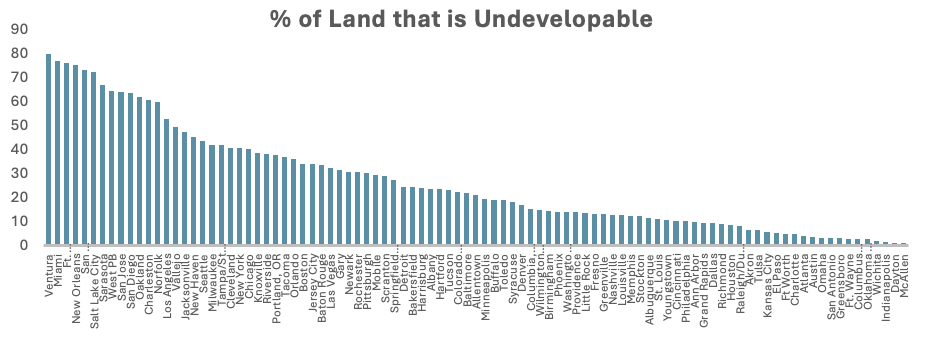

Professors at Wharton developed the Wharton Regulation Index to measure the relative difficulty posed by regulation across each of the major U.S. cities. Cities on the left should be more challenging for development.

3. Site availability. Finally, new competitive development requires land on which to build. Albert Saiz of MIT did a unique study where he measured how much of each city is physically able to be developed (and is not desert, or with large elevation change, etc.).

As shown below, cities with water and mountains have the least developable area while flat places in the middle of the country have lots of land.

These factors together suggest that the most supply-constrained areas the areas are places like San Francisco, Miami and San Diego, with large constraints on regulatory and physical development.

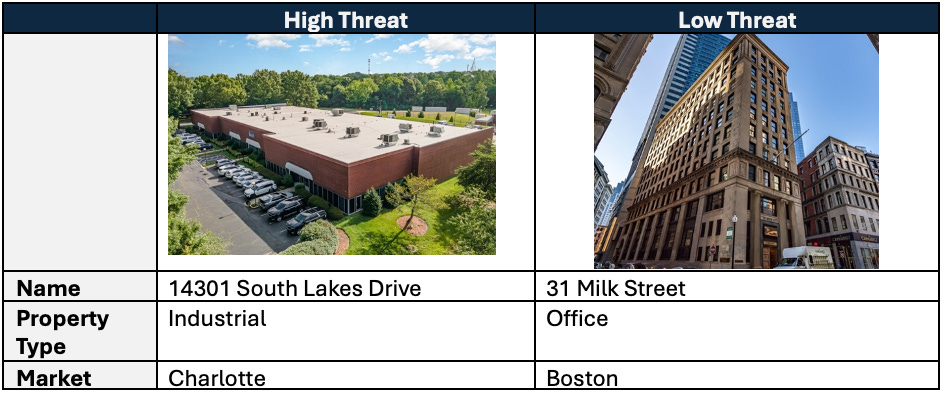

Two examples below offer different profiles on the threats from new competition. The office building in Boston likely has its own challenges, but new supply isn’t one of them. The industrial building in Charlotte will perpetually face this risk, as Charlotte is pro-development, with lots of land, and industrial is affordable and quick to build.

Bargaining Power of Suppliers

The availability and cost of inputs can significantly impact a company’s profitability. For example, restaurants rely on a variety of ingredients, while automakers depend on numerous parts from various suppliers. When there are few dominant suppliers, they can exert considerable influence over pricing and terms.

The real estate development business faces similar uncertainty from suppliers. The most recent cycle has seen dramatic swings in the prices of such crucial inputs to real estate development such as wood and concrete. In the busy part of the development cycle contractors and architects are busy, and they have leverage over developers. This is especially common in smaller markets with a shallow pool of suppliers.

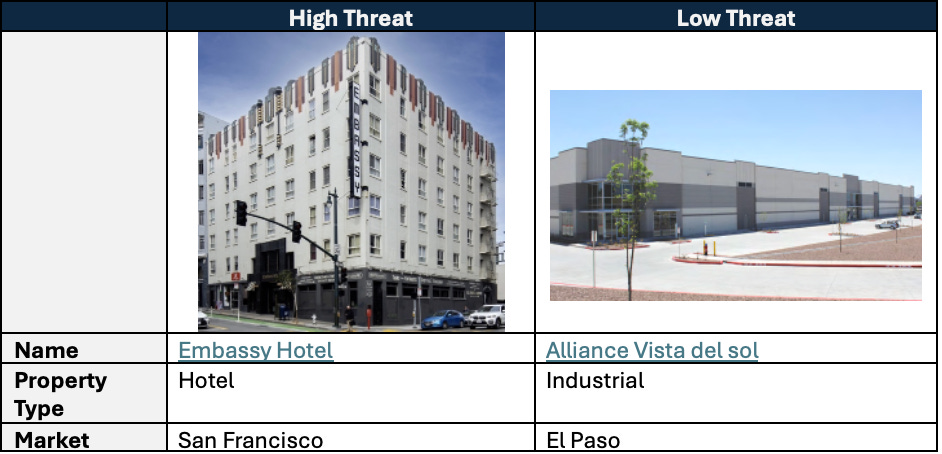

As we think about a property’s ongoing competitive positioning, the key input to real estate is labor. A typical higher end hotel employs dozens of staff while industrial properties essentially employ zero. In the past few weeks, there have been hotel strikes across the country. These strikes are most prevalent in the expensive markets and are a real threat for owners to underwrite.

Bargaining Power of Customers

For real estate, tenants are the customers. These can be individuals, in the case of multifamily, self-storage, hotels or retail, or businesses, for industrial, office and medical office.

The power of buyers is higher when there are few of them, and they have good information. For example, life science properties have a relatively small number of potential tenants due to the specialized nature of the space. The customers for an apartment building have little buyer power.

Buyers also have a lot of power when there are many sellers to choose from. An office tenant is in a much stronger bargaining position when there are 50 vacant blocks of space than when there are five.

Switching costs are also a consideration when considering buyer power. A dentist that has put substantial capital into their space is much more likely to renew due to the costs of fitting out a new space. This elevated “switching costs” increases the customer stickiness.

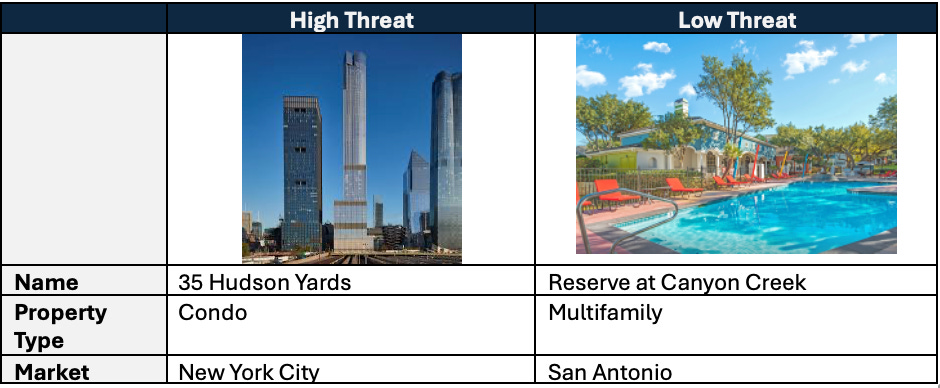

The below example shows 35 Hudson Yards, with condo prices ranging from $5 -$15 million. These buyers have leverage, especially today, when the building is 40% empty empty. On the other hand, the multifamily property in San Antonio has average rents of $1,300, affordable to the typical San Antonio households the households in the market. These customers have little bargaining power, as they are one of many.

Threat of Substitute Products

Real estate offers a unique advantage: limited substitutes. Unlike stocks or bonds, physical property cannot be easily replicated. This scarcity can contribute to long-term value appreciation

The past 20 years offers us two strong exceptions. Substitutes usually arise when a different technology arises to serve the same need. Retail used to be seen as the most core real estate sector. But online shopping rose as a viable substitute and reset the sector. Similarly, Covid, Zoom and WFH grew as a substitute for office space. Now office is undergoing the same transformation.

Insulation from substitution can best be accomplished by focusing on very specific needs (rather than wants) or providing a unique experience.

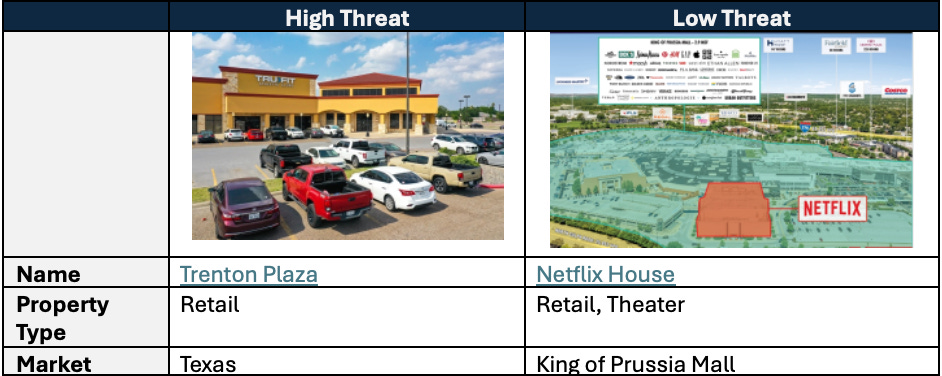

On the left is a very traditional movie theater. I love a movie theater but watching at home is a clear substitute, with lower costs. On the right is the new Netflix House concept at the King of Prussia Mall. This is more than a theater, it is an “immersive experience[1]”, far more than you can do at home.

Rivalry among existing competitors

The best businesses have no competition. The same is true for property. The inverse is that properties with lots of competitors will struggle to create profits more than the cost of capital, and to push rents through time.

The number and concentration of competitors determines the rivalry. For real estate, ownership is generally fragmented, with lots of small non-institutional owners. Owners can attempt to decrease rivalry through different tactics:

· Quality. Higher quality property should be able to differentiate against competitors. However, as we discussed last time, there is a rapid cycle of obsolescence, so it is tough to rely on quality alone as a competitive advantage.

· Brands. Disney World might be the most core real estate in the world, all due to the brand and experience. Similarly, hotels and malls rely on brand value to drive traffic.

· Barriers to exit or switching costs. Some properties are purpose-built, with large capital investment, which increases costs to switch. Rewards programs like Bilt have attempted to increase the barriers to exit for multifamily.

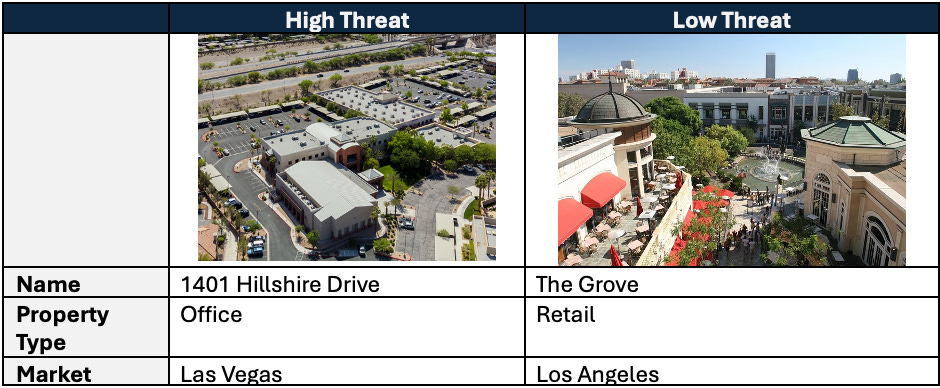

The below office building in the Las Vegas metro is commodity and faces competition from dozens of other buildings (in addition to the threat of WFH).

Meanwhile, The Grove in Los Angeles is a destination retail center, utilizing both brand and quality to position itself in its own category, and insulating itself from “rivalry”.

A Case Study

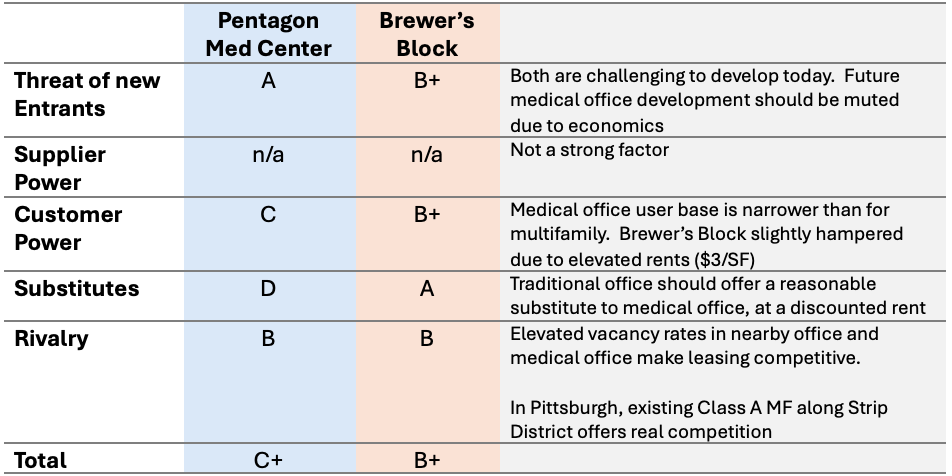

None of the five forces is perfect in isolation but when combined, they offer a helpful look at a property, to a deeper level than just attempting to underwrite near term supply and demand. Let’s combine them all and look at two properties currently on the market.

Property #1

Property #2

This cursory analysis would quickly suggest that the key question for each property is:

- For the Pentagon Medical Center, what is the potential competitive supply from traditional office buildings?

- For Brewer’s Block, how deep is the renter pool at these elevated rent levels and how deep is the rivalry in the immediate area?

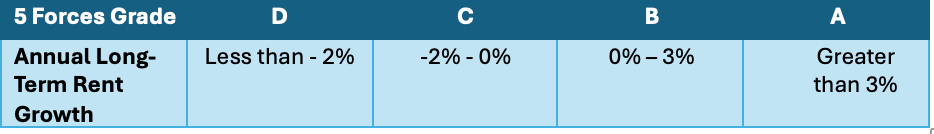

If you were both confident in the approach and ambitious, you could create a table and utilize the framework to underwrite long-term “through the cycle” rent growth for properties, which might look something like the below.

Investors blindly underwrite 3% per year for every property, simply because that is the convention, and roughly in line with historical inflation. However, the reality must be very different.

This simple model we just created would suggest that Brewer’s Block could enjoy rent growth of 3-4% while Pentagon Medical Center would be more like 0%. Is this right? I don’t know, but its directionally better than assuming they are simply the same. And then, of course, this still doesn’t tell us which is the better investment because we don’t know the price!

Leave a comment