Where Will the Best Opportunities be in coming years?

Recently an investor asked us an interesting question. He noted that a lot of investors were interested in the Midwest. Given our “Rise of the Rest” focus, is that where we see the best opportunities today?

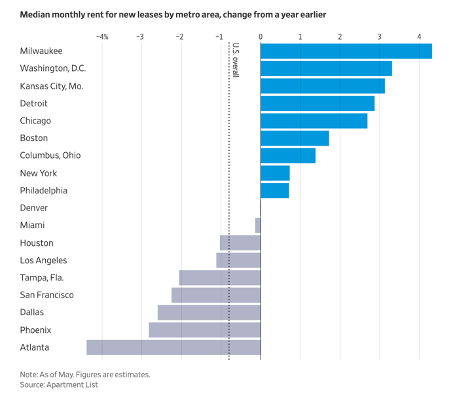

Along similar lines, The Wall Street Journal recently released a piece showing elevated rents, with growth especially strong in the Midwestern markets, such as Milwaukee, Kansas City and Detroit. When it hits the popular press like, the investor world is sure to follow.

We at Rise of the Rest have a sympathetic bent for the often-overlooked Midwestern real estate markets in the United States. We also have a preference for contrarianism. Those usually go hand-in-hand, but not today. Instead, we will argue that while the people in the Midwest are very nice, the better rent growth over the next few years will be elsewhere.

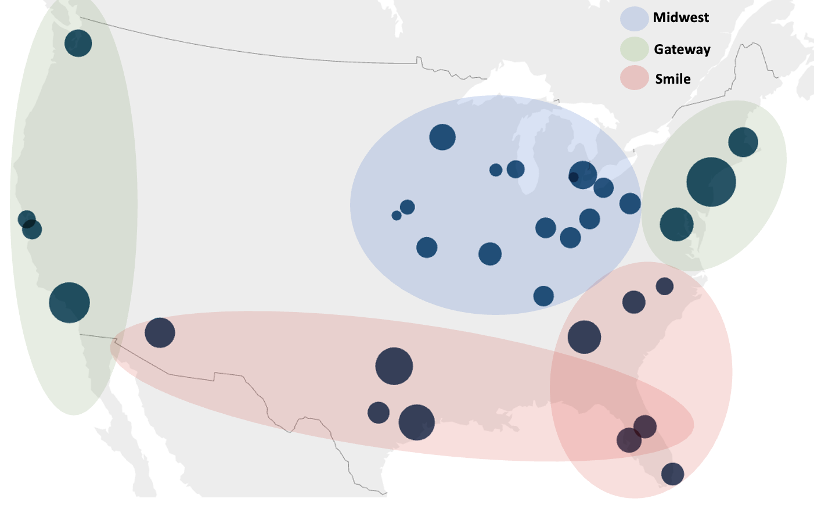

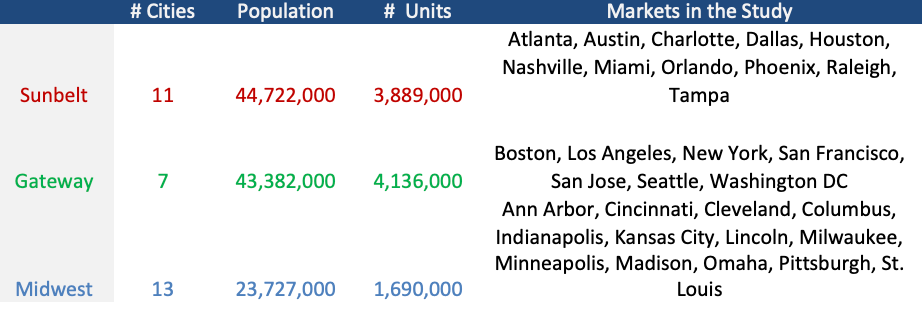

Investors use a shorthand for market selection, cutting cities into three broad categories:

1. “Gateway” or “Coastal” markets of New York, Boston, San Francisco, Los Angeles and Washington DC. These have historically been the “core” U.S. markets. Investors like them because of liquidity

2. The “Sunbelt” or the “Smile” markets captures the Carolinas, Nashville, Atlanta, Florida, Texas and west to Phoenix. Investors might also include smaller cities internal to these areas, such as Knoxville and Charleston. Investors like them because of growth

3. The final group is the Midwest. These are generally less popular with investors. Some of the markets such as Columbus and Pittsburgh garner interest but most of the others are popular with local investors only. Investors like them due to stability.

Just like investors vacillate between greed and fear depending upon market conditions, the desire for these three factors – liquidity, growth and stability – vary through the cycle. When things are going up, people prefer growth, when things are going down, they want stability and when things are scary, they want liquidity.

Historically, investors have preferred the larger Coastal markets. Covid changed this behavior, with investors piling into the Sunbelt in 2021 and 2022. Ask these investors why, and they will say “growth”. Which seems like a logical answer, right?

There is a problem-solving technique called the “5 Whys” that allows you to get to the heart of a matter. Let’s try it. Imagine it’s 2021 and we are asking a syndicator why they are focused on Texas and Florida.

Q: Why are you focused on those markets?

A: There is a lot of population growth.

Q: Why is that important to you?

A: Because that drives rent growth

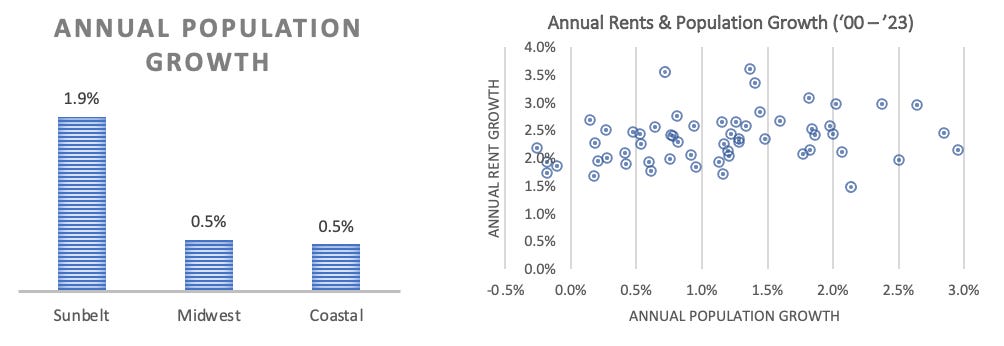

Ah, let’s test that. While population growth is valuable for filling new buildings, how important is it for an acquisition strategy? Believe or not, somewhere between very little and none at all. How much has the population of Manhattan grown over the last 100 years? Meanwhile places like Atlanta and Houston lead in population growth and often lag in rent growth. Over the long-term there is essentially no relationship between population growth and rent growth.

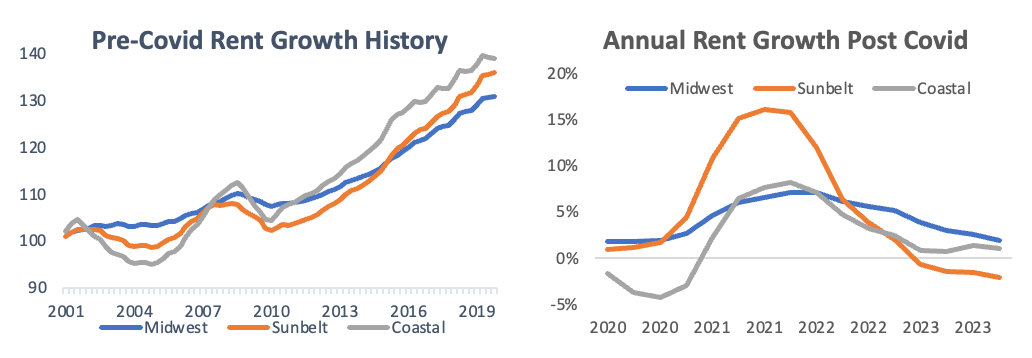

Instead, although the Sunbelt has had 4x stronger population growth, the “slow growth” Coastal markets have historically enjoyed stronger long-term compounded rental growth. This is mostly due to the supply constraints in markets like New York and San Francisco. Covid was a shock, with large changes in migration away from expensive markets and towards lower cost sunbelt markets. During this short period, migration did cause a brief rental spike which has now reverted.

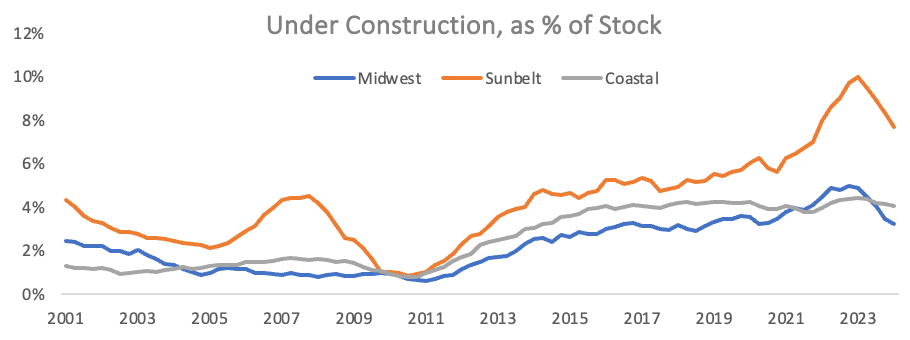

The rent spikes created a predictable developer reaction, and now the sunbelt is facing extreme levels of new supply, most acute in those areas such as Austin and Huntsville, which had enjoyed equally extreme rent growth.

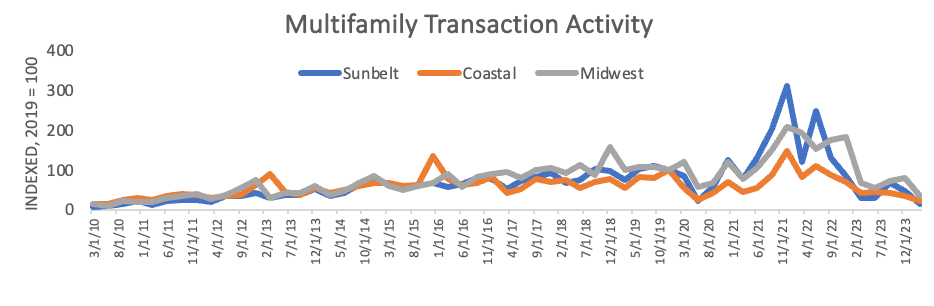

Capital has predictably followed. With sunbelt rents booming during the Covid years, capital flooded in, as shown below. And while sunbelt rents have slipped recently, capital interest has as well, causing a decrease of 75% since 2021, compared to a more moderate decline of 50% for both the Gateway and Midwest markets in 2023, compared to 2021.

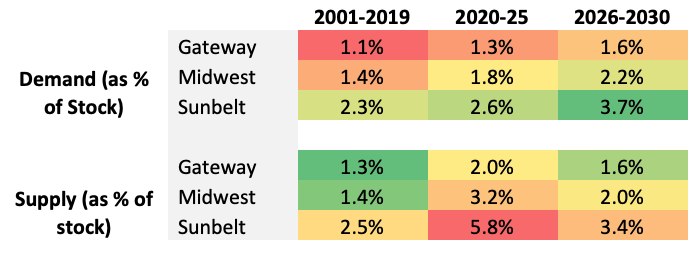

Over the long-term, the Sunbelt markets have had the highest levels of both demand and supply. During this current cycle, the Sunbelt is getting massively overbuilt with 5.8% of existing stock added per year between 2020 and 2025, double the rate of demand. This is causing a large increase in vacancy and keeping investors away. The below forecasts (from CoStar) for the 2026-2030 period suggest that this will reverse, with demand outpacing supply. We think this could be conservative, with the supply shutdown more dramatic than their models expect.

Demand differences across the Gateway, Sunbelt and Midwest markets are structural. Population growth will continue towards places that are warmer and cheaper. However, supply is cyclical. When the current supply cycle wears off, you will be better served in the sunbelt.

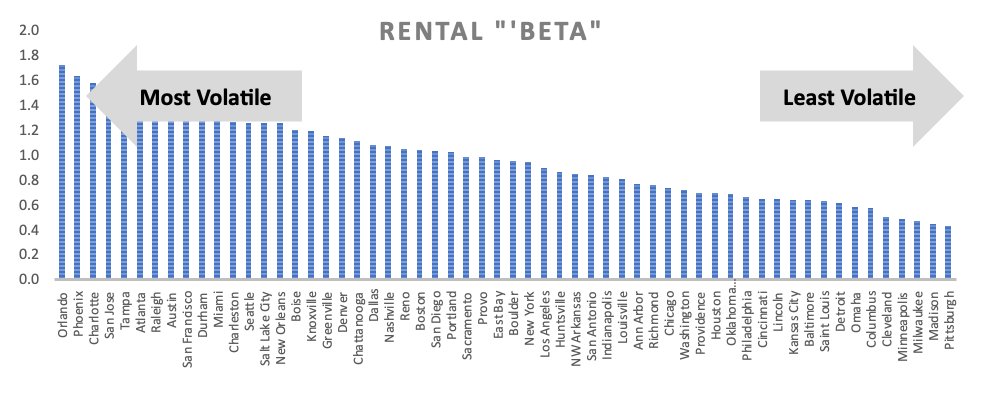

Investors currently prefer the Midwest due to its lower volatility. However, volatility is not always a bad thing. At the bottom of a cycle, volatility is your friend, offering outsized symmetrical returns in the recovery. The better way to time the cycle is to rotate into the stable Midwestern markets closer to the top, and the more volatile markets, today closer to a bottom.

Our belief is that while we think are great arguments for owning real estate in the Midwest over the long term (affordability, climate, human capital), the current environment is more favorable for the sunbelt markets.

To summarize the argument:

· There are three categories of U.S. multifamily markets: Midwest (stable), Coastal (liquid) and Sunbelt (growth)

· The Midwest markets are currently outperforming because they don’t face as much supply. This, along with their stability, is drawing capital

· The sunbelt markets are currently facing a wave of oversupply and soft fundamentals.

· Over the next few years, rents will grow the most in the “high beta” markets of the sunbelt, as the cyclical supply is absorbed and the structural demand remains in place.

Sources: CoStar, WSJ, ApartmentList, U.S. Census

Leave a comment