What the heck is the office market anyway? Making blanket statements about the “office” market is like watching Chris Helmsworth and Danny Devito do pushups and forming a conclusion about the health of “men”.

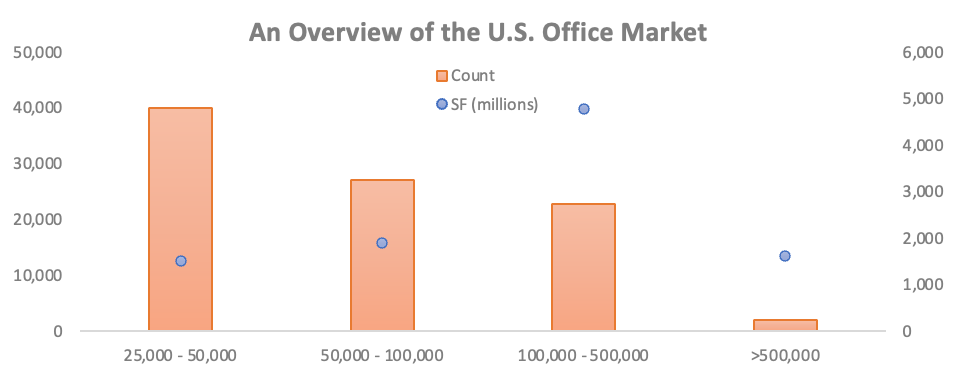

In the U.S., there are about 100,000 individual buildings accounting for roughly ~10 billion square feet of space. Half of the buildings were built more than 40 years ago. Our estimates suggest that users should need roughly 30% less space in the future, due the changes in workspace usage. Many people suggest that is dire for the market. I believe the opposite, that there is a shortage of the type of workspaces that people actually want.

I appreciate the retail market, because it breaks more cleanly into subcategories like malls, lifestyle centers, grocery anchored, strip centers, etc. You can easily picture each of these, and understand why people might visit.

In these paragraphs I want to take one small step to try to similarly clarify the office market. This piece is not intended to answer every single question about the future of the office market! It’s the type of piece that is written with a pint of Guinness, and ideally read with one too.

“The Urban Magnet”

Description: Urban, nicely designed and well-located. You WANT to be there. It’s expensive and used to woo prospective clients and workers

Popular Culture Example Mad Men

Portion of the Market: 10%

Real World Example: One Vanderbilt

Outlook: A Being in this environment should be close to joyful, with easy access to good food, other productive people, fitness options, clean air and spaces conducive to good work.

“Neighborhood Space”

Description: Smaller workspaces near residential areas.

Popular Culture Example: Halt and Catch Fire

Portion of the Market: 5%

Real World Example: The Continental Gin Building in Dallas, operated by Common Desk. You walk through the doors, and feel 20% more creative (and 30% less attractive)

Outlook: A These spaces are near residential areas minimizing the commute problem. Relatively low cost and offers flexibility.

“Scenius”

Description: Tech and Media spaces, mostly in urban areas. Scenius is represents the combinatorial power of having diverse smart people in close proximity.

Popular Culture Example: Silicon Valley, Devil Wears Prada

Portion of the Market: 5%

Real World Example: IDEO’s Palo Alto Studio, Soho House, maybe (?)

Outlook: B+ Places that facilitate the gathering of smart and ambitious people will always work

“Space on Demand”

Description: Remote work ¹ WFH. Many people with remote and work lifestyles require a portfolio of various workplace options.

Popular Culture Example: Up in the Air

Portion of the Market: 5%

Real World Example: LifeTime Fitness, Coworking, Breather

Outlook: A Today’s workforce needs convenience and flexibility. Most of the existing inventory is inconvenient (long commute) and inflexible (long leases). Workspaces are needed in smaller bites and closer proximity to people

“The Dirty Dunder”

Description: The original “flex office” with both office and warehouse

Popular Culture Example: The Office. I’m guessing that in total they are leasing 20,000 SF in the Scranton Business Park, more than half of which is Darryl’s warehouse.

Portion of the Market: 2-5%

Real World Example: Drive to the part of your town where the 18 wheelers go, and there are lots of potholes, and look around

Outlook: B Having the ability to make and distribute goods creates some differentiation for the office space

“Medical Office”

Description: Office buildings located near hospitals and residential areas to provide out-patient services as well as services like dentistry and dermatology.

Popular Culture Example: Horrible Bosses

Portion of the Market: 5%

Real World Example: I personally office in this building. I share one wall with a psychiatrist and another with a dermatologist. Cross my heart.

Outlook: C+. To the extent these operations continue to require in-person visits, these spaces will still have demand, but operations will always be a challenge.

“HQ”

Description: Corporate Headquarters where a single large company takes all the space

Popular Culture Examples: Wolf of Wall Street, The Internship, The Circle

Portion of the Market: 10%

Real World Example: JPMorgan’s new headquarters in Manhattan. My 2nd job was with Nuveen (then TIAA-CREF) in this building in Charlotte. It was nice, but isolated.

Outlook: D The exceptions are those where the spaces are so unique and appealing (e.g. Googleplex) that the employees actually want to be there. Those are a minority, and the more typical example is more akin to a suburban backwards magnet (see below)

“The Suburban Backwards Magnet”

Description: Dull, boring suburban office parks.

Popular Culture Example: Office Space

Portion of the Market: 20-30%. CoStar data shows that 40% of the office inventory in the U.S. is suburban. At least half has gotta be the backwards magnet.

Real World Example: My first job in 2004 was in this building in Charlotte. For a while, I thought I didn’t like working. Later I realized it was just the office.

Outlook: F A tiny portion can be redeveloped or densified with residential. The rest should become parks.

The problem is that when people talk about the “office”, we don’t know if the particular building is a Scenius or a Dirty Dunder!

Various studies (including our own) suggest a going-forward 30% decrease in office demand due to work-from-anywhere. If 20% of the market consists of Negative Magnet suburbs, then those alone can absorb the majority of the decrease in office demand.

I believe that the other types of workspaces (especially Magnets, Neighborhood Offices, and Scenius) are actually undersupplied.

Leave a comment