In the early days of the pandemic, Marc Andreeson penned the piece It’s Time to Build. This argument for more manufacturing – of vaccines, machinery, chips, roads – was a compelling one, especially when rates were zero.

It was true for real estate as well. Covid caused a shock to space usage, requiring more beds as households unbundled, causing a spike in new demand, especially in rural and suburban areas, as people were unshackled from their downtown jobs. There was also a need for new warehouse and distribution space, as people were forced to stay inside and buy more of their stuff online.

During the last three years real estate developers responded to these facts and built unprecedented amounts of new apartment and industrial buildings.

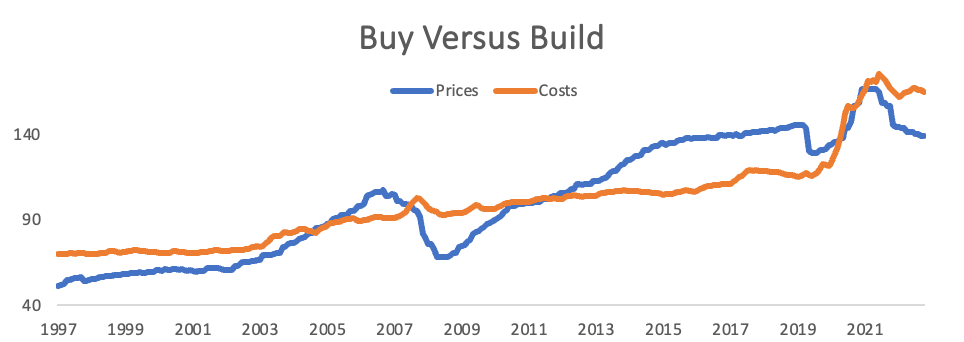

Things are different now. Higher interest rates have made it more expensive to undertake new projects, and lower property values make the economics unappealing. The below indices represent the costs of new construction compared to the values of existing properties. This proxy index shows that prices are currently 16% below construction costs, which is the greatest discount since a brief window in 2008-09, which turned out to be a great time to buy.

New development is important for a changing and dynamic society, and this was Andreeson’s point. And as the cycle progresses, and property values increase, and construction costs moderate from their pandemic spikes, it will become time to build again. Until then, better to buy.

Leave a comment